Lynn and Harry Fryckberg’s family have a relationship with

Virtua that goes beyond patient care. They are also partners

and advocates who give back to strengthen the health of

their community.

“Whether it was giving birth to my son 24 years ago or

visiting the ER years later for his sports injuries, Virtua has

been there for us,” said Lynn.

Lynn’s support began when she enrolled in Virtua’s animal

assisted therapy program with her beloved dog Lainee. She

also serves on Virtua Foundation’s Board of Trustees and is

Chairperson of the Gift Planning Advisory Council.

In 2013, Lynn was inspired to do even more by Marvin

Samson, donor and Virtua Board member, who said donors

should voice their giving in the hope that others will follow.

Lynn then designated Virtua Foundation as a beneficiary of her

will/trust and directed the gift to Virtua’s nursing program.

Lynn developed a passion to support nurses during the hours

she spent at the hospital with her dog, Lainee.

“Nursing is very difficult work, but the Virtua nurses do it

with a smile and are very involved with the families in a

calming and professional manner,” said Lynn.

The Fryckbergs’ commitment to Virtua through the

Foundation’s planned giving program allows them to have an

impact today and in the future, creating a meaningful legacy

around a cause that’s important to them.

“It’s important to let people know while you are living what

you would like to do with your assets,” said Lynn. “The

process of creating or updating your will shouldn’t stop you.

It is one of the easiest, most impactful, gifts you can make.”

Family’s connection to Virtua leads

to a lasting legacy

Inspired to Give

determine the value of your property; inventory your assets and debts:

You have to know what your assets are and how much they are worth

before you can properly plan your estate.

Prepare a list of beneficiaries; consider charitable giving:

Decide how to

divide your assets among your beneficiaries and if you want a set sum

donated to charity. This will provide a charitable tax deduction for your

estate and allow you to give back even after you are gone.

Choose an executor:

An executor has responsibilities such as notifying

interested parties of your death, paying outstanding taxes, and distributing

your assets according to your Will. If you don’t have a Will or if your Will

does not name an executor, the courts will appoint one.

seek the advice of an estate Planning attorney:

Working with an estate

planning attorney will help you create a Will that distributes your assets to

your intended beneficiaries in a tax efficient manner.

-- Submitted by Stephanie E. Sanderson-Braem, Esq., Stradley Ronon Stevens & Young, LLP and

member of Virtua Foundation’s Gift Planning Advisory Council.

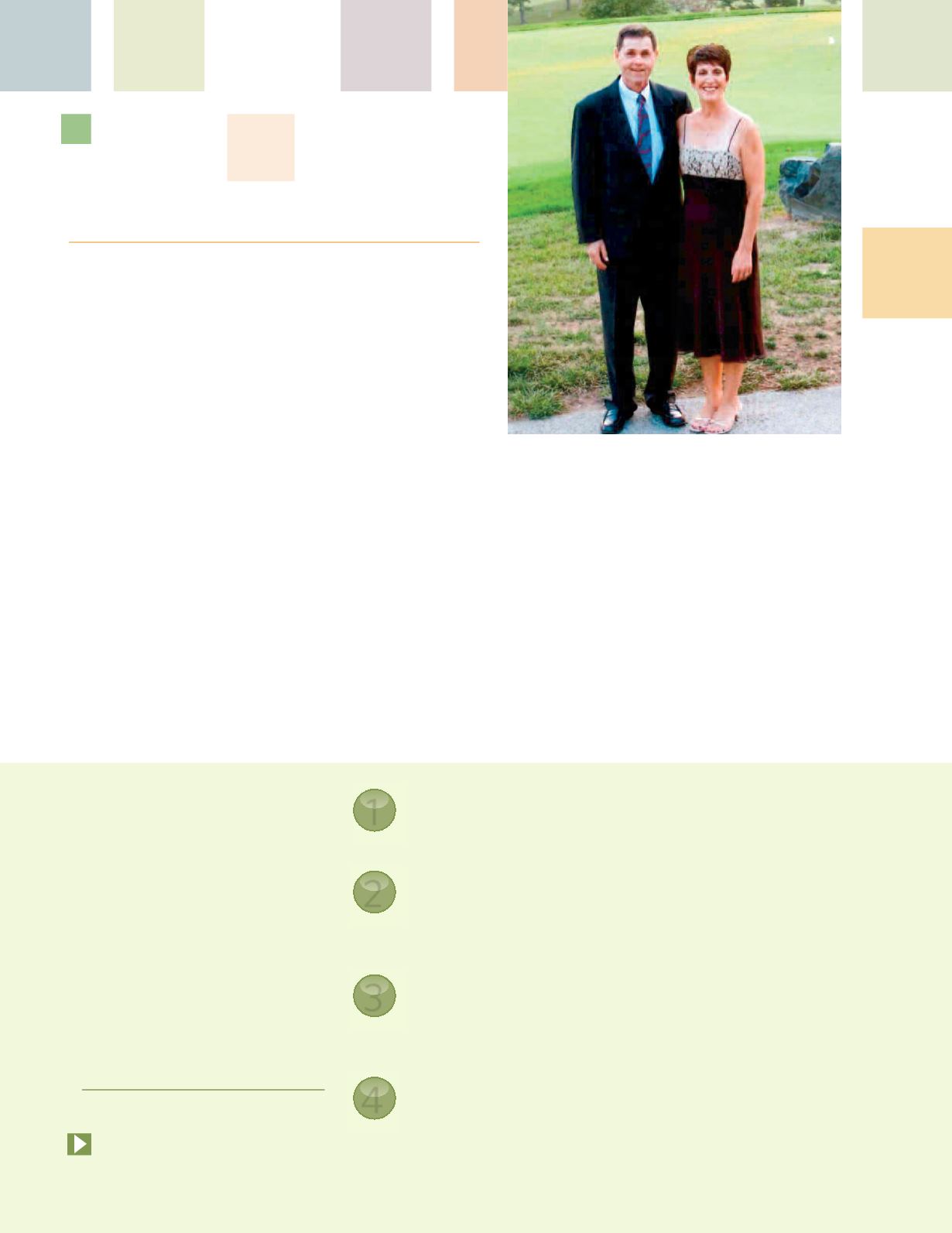

Harry and

Lynn Fryckberg

easy steps to

Create a Will

4

2

3

4

1

For more information on gift

planning with Virtua Foundation

vist virtualegacy.org.